Last month we announced that we’ll be partnering with The Samfund at ASTRO, and today we’re pleased to share an interview with The Samfund CEO, Samantha Watson. Sam is a two-time young adult cancer survivor and passionate about providing support to other young adult survivors. It’s our pleasure to share her insight into the unique financial challenges faced by survivors, and how the healthcare industry has responded.

The Samfund is a nonprofit organization that provides support to young adults who are struggling financially because of cancer, and a 2016 recipient of the ASTRO Survivor Circle Grant. We’re teaming up at ASTRO to learn more about how the oncology community engages with survivors, while also raising money to support these survivors. To join in, please visit booth #9051 at ASTRO September 25 – 27th in Boston, MA and complete a brief survey describing your successes and challenges with survivor engagement. For each completed survey we’ll donate $25 to The Samfund!

Learn more about Sam, the financial side of cancer treatment and how we can all help here…

What led you to found The Samfund after surviving cancer?

![]() Gratitude. I was treated for cancer on the pediatrics floor (although I was 21 at the time of my first diagnosis and 23 at the time of my second), and more often than not had roommates – kids – who were completely alone. It was heartbreaking. I realized afterwards how fortunate my parents and I were to have family and friends surrounding us all the time; they filled the waiting room, kept me company during my chemo, sent cards, and called constantly. I never had to wonder what it would be like to go through cancer alone — and I know exactly how lucky I am to be able to say that. So, when I was finished with treatment, I knew I needed to pay it forward.

Gratitude. I was treated for cancer on the pediatrics floor (although I was 21 at the time of my first diagnosis and 23 at the time of my second), and more often than not had roommates – kids – who were completely alone. It was heartbreaking. I realized afterwards how fortunate my parents and I were to have family and friends surrounding us all the time; they filled the waiting room, kept me company during my chemo, sent cards, and called constantly. I never had to wonder what it would be like to go through cancer alone — and I know exactly how lucky I am to be able to say that. So, when I was finished with treatment, I knew I needed to pay it forward.

I also realized, after my treatment ended, that my transition back to the “real world” could have been a whole lot worse. Physically, psychologically, and emotionally, it was hard. But on a practical and financial level, it probably wasn’t that much harder than what other young adults were facing. I had a friend whose company hired me over the phone because I spoke Spanish, so they didn’t see my nearly-bald head or my crutches. I had another friend who was looking for a roommate in a reasonably priced apartment in Boston. I also had support from my parents and family, so I never needed to be afraid of being homeless or struggling to buy food. Most importantly, though, I didn’t have a stack of medical bills waiting for me (thanks to good insurance and a mom who, as an oncology nurse, had the knowledge to battle our insurance company – for three years – when they tried to refuse payment). I started meeting young adults who didn’t have these supports in place, and who were floundering. I was 25 years old at the time and didn’t have much in the way of professional skills or experience, but I knew that if all I needed to do was raise money to help people pay their bills, I could figure out a way to do that. And The Samfund was born.

It’s clear from your experience that there’s a need for more financial education and support within the cancer care system. What would you see as the most important thing the medical community could do for young adult survivors?

Being diagnosed with cancer is often a total shock, and intensely emotional. The last thing most people are thinking about is how much it’s going to cost. We are working on ways to empower patients by providing them with information and encouraging them to ask the right questions, but it’s equally important for providers to bring up the topic of cost as early in the treatment process as possible — even just to acknowledge that cancer is likely to be expensive, and to ask whether it will be an issue. It’s an uncomfortable subject, but critical that these conversations take place early. Providers should encourage patients to seek out financial assistance programs through the hospital (and there are many) and help them make well-informed decisions; there are plenty of ways in which appointments can be scheduled (e.g., so as not to miss work) or medications can be administered (e.g., at home or in clinic) that can impact total cost and/or insurance coverage. All of this can go a long way in mitigating the financial pressure later.

Have you seen a shift in how the medical community addresses the financial aspects of cancer since founding The Samfund?

On the whole, yes. The fact that people are even talking about cancer costs is a huge improvement over 2003, when The Samfund was created. Back then, it felt like we were shouting but no one was hearing us; now, we have a louder voice in a much larger conversation. Still, there is a lot of work to be done. While hospitals have financial assistance programs, and pharmaceutical companies have co-pay assistance programs, many people don’t know about them, so there is a lot of money left on the table each year that could go a long way in helping to prevent the financial crises that we often see. There is a shared responsibility here — between advocates and medical providers — to make sure patients know about, and can access, these resources.

Based on our own experience in this industry, we’ve seen an increase in the use of Financial Navigators. Do you think this will help?

Absolutely. Part of the problem is that cancer is prohibitively expensive (which most people don’t realize until they’re already in debt). But the bigger issue, as we see it, is that people are blindsided by these costs. There are a lot of ways in which understanding the costs earlier in the treatment stage can lessen the financial blow later on. For one, there may be ways to manage the costs by addressing them upfront: accessing co-pay assistance programs, getting on payment plans through the hospital, finding external resources and organizations to help with a variety of bills (shout out to our friends at Family Reach for supporting children and families during treatment), and so on. For anyone who’s reading this who may be facing treatment-related bills, please, do not put everything on a credit card or ignore bills until they go to collections; both of these actions can come back to bite you. Being proactive with your bills usually helps to make things easier down the line (smaller finance charges, avoiding collections, etc.). Even when it may not be possible for someone to pay-as-they-go during treatment, just having a sense of the total cost of cancer treatment (taking into account missed work, everyday living expenses, co-pays, etc) can help someone budget accordingly and fend off that sticker shock later on.

to help with a variety of bills (shout out to our friends at Family Reach for supporting children and families during treatment), and so on. For anyone who’s reading this who may be facing treatment-related bills, please, do not put everything on a credit card or ignore bills until they go to collections; both of these actions can come back to bite you. Being proactive with your bills usually helps to make things easier down the line (smaller finance charges, avoiding collections, etc.). Even when it may not be possible for someone to pay-as-they-go during treatment, just having a sense of the total cost of cancer treatment (taking into account missed work, everyday living expenses, co-pays, etc) can help someone budget accordingly and fend off that sticker shock later on.

You recently published an article analyzing the financial impact of cancer on young adults. Did any of the conclusions surprise you?

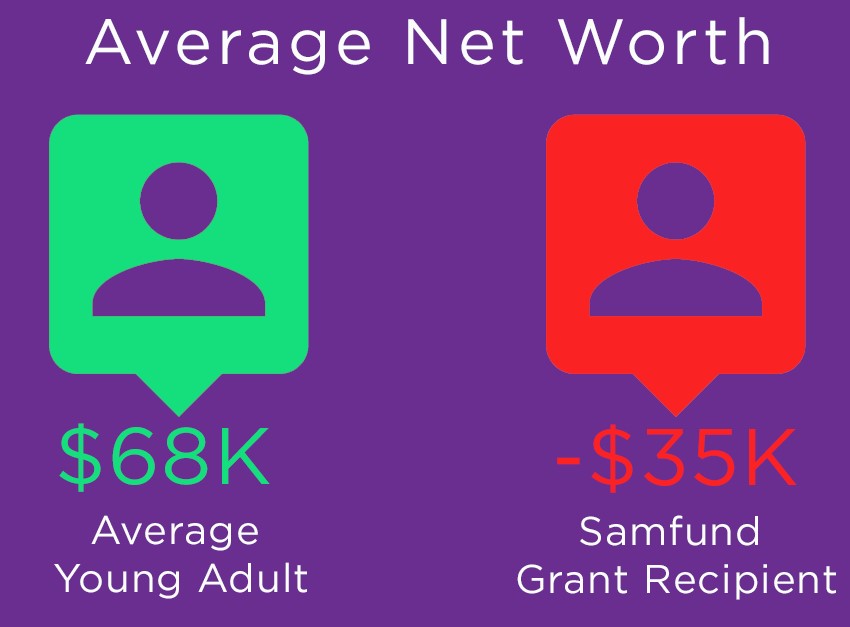

The data used in our paper came from our grant applications (with permission) and reflected stories we hear on a regular basis. The biggest surprise, though, came when we compared the financial information of our grant recipients to their peers (via US Census data). What we found was that our “Samfund alums” had an average net worth of -$35,000, compared to $68,000 in the general population. That’s a $100,000 difference. It is a staggering figure and has motivated us to find ways to close that gap.

What do you wish you could say to young adult cancer patients as they move into the survivorship phase?

Finishing cancer treatment is both a great ending and beginning point. You have wrapped up one of the most difficult things that any young adult should ever have to face – be proud and celebrate in your own way. While you do, make sure to remember that you’re continuing your life with a new point of view, experiences most of your peers haven’t had, and maybe some questions and fears. Even as you physically start to feel better, make sure you’re honest with yourself and prepared for some of the difficulties that are inherent with this new stage. When things get tough, reach out for help. There are many great organizations dedicated to helping young adults during and after treatment. We are here to support you in every way we can.

What’s next for The Samfund? Any big plans we should know about?

We have been hearing the same stories, and seeing the same challenges, for over a decade. It’s not okay. While we will continue to provide direct financial assistance for as long as it’s needed, we are working on ways to intervene earlier so that young adults don’t find themselves in financial crisis. What does that mean? It means that we are taking a step back and looking hard at the cause of these crises. In many cases, having better guidance and appropriate information could mean the difference between moving forward and moving backwards. We are a few weeks away from launching a “Finances 101” Toolkit, in partnership with Triage Cancer, to help young adults – and anyone else who needs it – make well-informed decisions during and after treatment so that recovering financially doesn’t become a lifelong struggle. Shifting our focus to prevention, through financial literacy and education, is an important step for The Samfund. We are excited to be a leader in this space and look forward to the day when no one needs our grants at all!

We’re excited to see what the future holds for the Samfund and proud to support them along the journey. To learn more about The Samfund, or make a donation, please visit www.thesamfund.org.